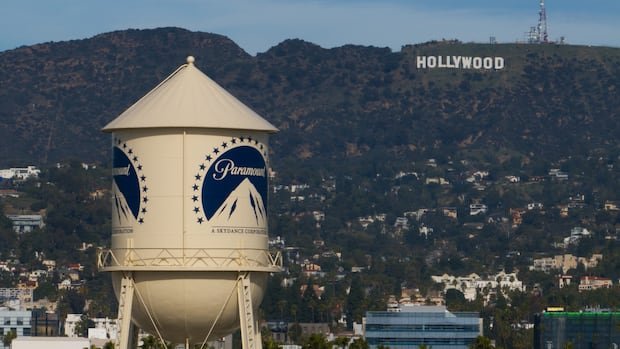

Warner Bros. Discovery is reopening discussions with Paramount, a Skydance-owned company, to consider their “best and final” offer. This move comes as Warner Bros. Discovery stands by its deal with Netflix despite the ongoing talks. In a regulatory filing on Tuesday, Warner Bros. Discovery disclosed that Netflix granted them a waiver to engage in discussions with Paramount for the next seven days or until Monday to address any outstanding issues and clarify terms in Paramount’s latest offer. Although Paramount had previously made hostile bids, Warner Bros. had rejected them. The company reiterated its commitment to the Netflix merger, stating that its board had not found Paramount’s proposal to be superior. Warner Bros. leadership has consistently supported the $72 billion deal with Netflix, encompassing its studio, streaming business, and HBO Max. The total enterprise value of the deal, including debt, is approximately $83 billion. This decision to re-engage with Paramount marks a change for Warner Bros., as Paramount had expressed frustration over the lack of meaningful engagement before the Netflix merger announcement. Netflix also expressed confidence in its deal with Warner Bros., emphasizing the superior value and certainty it provides. Paramount, on the other hand, maintained its $30 per share tender offer and readiness for constructive discussions. Unlike Netflix, Paramount aims to acquire Warner Bros. Discovery entirely, including networks like CNN and Discovery, with a bid of $77.9 billion in December. Paramount indicated willingness to increase its offer to $31 per share pending engagement. Both companies have made efforts to enhance their offers, including Paramount’s additional incentives if the deal falls through and commitment to pay the breakup payout to Netflix. The successful bidder will gain control of Warner’s substantial film and TV library, featuring classics like “Casablanca” and “Citizen Kane” and popular HBO shows like “Game of Thrones.” Regulatory approval will be necessary for any sale, and Warner Bros. has a shareholder vote scheduled for March 20 regarding the Netflix merger. Warner Bros.’ stock rose over 2% ahead of the market opening, while Paramount Skydance and Netflix also experienced slight increases in their stock prices.