Alberta’s orphan well woes are about to swell following the end of a controversial court case involving some of the biggest names in the Canadian oilpatch.

The province’s Orphan Well Association (OWA) is tasked with cleaning up oil and natural gas wells that no longer have an owner, something that is often caused by a company going bankrupt.

The OWA already has an inventory of about 1,600 wells in need of closure and reclamation. That workload is expected to more than double as the bankruptcy of Sequoia Resources is finally settled — a court case that has been followed closely by many because of its broad implications for landowners, industry and taxpayers.

With Sequoia, the OWA is expecting to inherit 1,800 to 2,000 more wells, in addition to the company’s other infrastructure, such as pipelines. The estimated clean-up cost of the Sequoia properties is about $200 million.

As a result, the OWA now expects it will likely need more than a decade to clean up Sequoia assets, with a scheduled completion around 2036. That timeline could increase further if other oil and natural gas companies go bankrupt.

The bankruptcy trustee, PricewaterhouseCoopers (PWC), is expected to seek court approval to sell some of the Sequoia assets that still have value in November, said OWA president Lars DePauw. Everything else will be considered to be abandoned and handed over to the OWA, he said.

“There’s a lot of additional infrastructure,” DePauw said. “We’re getting a pretty significant portion of the wells, and with that comes facilities and pipelines and road infrastructure. That’s all part of that.”

Broad implications

Sequoia went bankrupt in 2018, but most of its natural gas wells have sat idle as the court battle dragged out.

And many landowners have been waiting for those aging wells to be cleaned up. An open house was held this summer to give some rural residents an update on when reclamation work might actually begin.

“It’s been a tough situation for the landowners,” DePauw said. “A lot of people are looking forward to these sites being removed from their land and being able to put them back into productive use.”

The Sequoia bankruptcy hearings attracted attention from big-name companies such as Cenovus Energy and Canadian Natural Resources. They, along with other companies, are affected because they pay into the OWA to clean up orphan wells. In court filings, those companies warned there could be industrywide consequences if similar deals as those that helped build Sequoia are allowed in future.

The OWA’s budget has steadily increased in recent years in anticipation of the Sequoia assets, which has resulted in higher levies charged to industry.

And taxpayers have increasingly covered some of the cost to clean up aging wells, including the federal government’s $1.7-billion commitment in 2020, which also aimed to provide stimulus for the oilfield service sector when oil prices crashed after the pandemic began.

The $1 deal

Part of the reason for the lengthy bankruptcy court battle was the controversial way Sequoia was built — and how quickly it failed.

The case has its origins in the reorganization of Perpetual Energy in 2016. That Calgary-based company transferred many of its money-losing properties to an associated company. Then Sequoia, which was founded by a pair of Chinese investors that same year, acquired those assets in a deal for $1.

Sequoia would go bankrupt in 2018.

The trustee in the bankruptcy, PWC, sued Perpetual, arguing the energy company knew the assets would sink Sequoia because of its aging wells and the nearly $134-million worth of reported environmental liabilities.

In court, Perpetual said the deal was done properly and that it went to great lengths to ensure Sequoia would be a success.

Shortly after Sequoia’s bankruptcy, the Alberta Energy Regulator acknowledged it needed to tighten the rules to ensure it wouldn’t approve such deals in the future and allow financially weak companies to take ownership of assets burdened by hefty looming clean-up costs.

The bankruptcy hearing had its own controversy.

PWC sought $217 million in damages from Perpetual.

In 2021, while the bankruptcy battle was ongoing, Perpetual stored the majority of its assets into a new company called Rubellite Energy, which would have the same employees and office space as Perpetual.

The OWA and PWC opposed the move in court, arguing it would diminish how much money could be recovered if Perpetual lost the bankruptcy case.

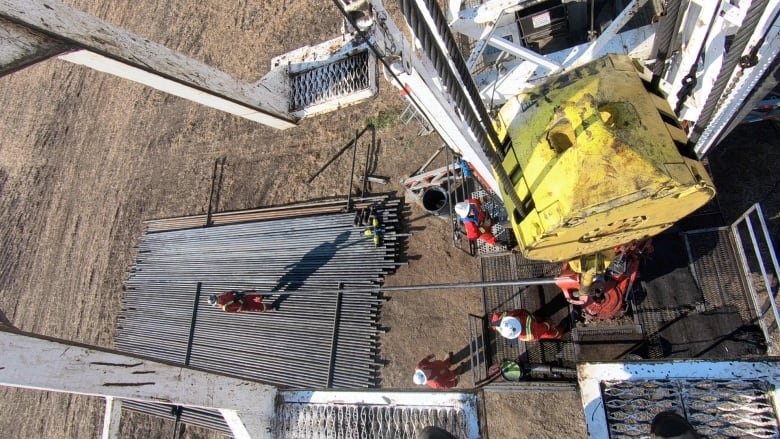

This is how inactive and orphaned oil and gas wells in northern B.C. are cleaned and dismantled.

“The Rubellite transactions and the proposed arrangement represent a radical solution to Perpetual’s overwhelming financial problems: the establishment of Rubellite as a successor entity, free of Perpetual’s obligations, to its creditors and other stakeholders,” submitted PWC in a court filing. “Perpetual’s shareholders receive clean shares in a ‘pure’ successor entity with ‘no debt.'”

Perpetual chief executive Sue Riddell Rose described the move differently, calling it a way for “Perpetual shareholders to benefit through Rubellite to unlock the value of these high-quality assets while at the same time providing a full capital solution, reducing Perpetual’s leverage and improving its liquidity to surface value from Perpetual’s remaining asset base.”

The creation of Rubellite was allowed, leaving Perpetual with a much lower value.

No trial

In March 2024, a settlement was reached to end the court case centred around whether Perpetual was responsible for Sequoia’s bankruptcy. Perpetual agreed to pay $30 million, “without any party admitting liability, wrongdoing or violation of law, regulations, public policy or fiduciary duties.”

The money will go to the OWA to help pay for some of Sequoia’s estimated $200-million clean-up costs.

In a court filing about the settlement, PWC senior vice-president Paul Darby described the litigation as contentious and expensive, while a trial would still have been several years away.

“The settlement offer is approximately equal to the current market capitalization of Perpetual,” he said. “Even if the trustee is successful ultimately, the Perpetual defendants are unlikely to be able to pay any significant monetary judgment.”

Still, the settlement means there are unanswered questions, said Drew Yewchuk, formerly a staff lawyer with the University of Calgary’s Public Interest Law Clinic who has closely followed the complicated case.

“I’m annoyed that this settled,” he said. “I was looking forward to the full disclosure process and a trial and finding out in full detail what had happened and then getting a court’s opinion.”

Following the settlement, Perpetual and Rubellite announced this month they would become one company yet again.

For Yewchuk, the move could reinforce the notion argued in court by the OWA and PWC that the creation of Rubellite would limit how much Perpetual could potentially pay if it lost the bankruptcy case.

“Without being able to conclude why that happens, and there can always be other business reasons, I can see why that would make a lot of people suspicious,” he said.

Riddell Rose, who is CEO of both Perpetual and Rubellite, said in an email she would not be able to comment to CBC News ahead of a shareholder meeting in October. Instead she referred to prior public comments about the court case and the two companies.

Currently, Perpetual has a market capitalization of about $30 million, while Rubellite is worth about $150 million.

When the merger was announced, Riddell Rose described the deal as providing shareholders with “valuable synergies, both quantitative and qualitative.”

The combined company would use the existing executive team and operate as Rubellite Energy.

New rules

Since Sequoia’s bankruptcy, Alberta’s energy regulator has tightened up policies to prevent similar deals, something that is proving to be effective, said DePauw, with the OWA.

Still, there are holdover cases involving companies that were able to purchase assets prior to those changes, and some of those are now in bankruptcy proceedings.

The Alberta government is trying to amend its own rules, including how much companies need to set aside to address the eventual clean-up costs of oil and gas wells.

While discussing the possible changes, Premier Danielle Smith specifically named Sequoia as a situation that needs to be prevented in the future.

“There has been an idea that liability could just be carried forward to the next purchaser with no dollars following it. And as a result, when companies get in trouble and they go under, if they have a lot of discontinued wells, it goes to the Orphan Well Association. We’ve seen some major problems with Sequoia, AlphaBow, there’s probably a handful of others,” she said to reporters this week.

“We don’t have any answers about what the future will hold for that just yet.”